Time to be dynamic

2024 has kicked off with a slightly different mood in the business world. We seem to have shifted from mild pessimism to cautious optimism. That might not seem like much (and it’s not hard to find concerns over geopolitics, debt and inflation), but after a long period of “soft landing” talk in the US, “steady as she goes” seems to be the mood over here now.

That doesn’t mean change stops. As you’ll see below, there seems to be a lot of shuffling in the world of high-end CFOs and CEOs. I think this tells us to expect some big changes in corporate strategies. That’s certainly the message I’ve been getting from the advisory community, where lawyers, tax advisers and deal-doers seem primed for action this year.

These changes in the corporate world trickle down. Acquisitions and disposals open up opportunities for FDs and CFOs across the pool – whether it’s exploiting new strategies or new opportunities. MBO anyone?

Is change always positive? Well, if you’re dynamic in your approach – and can instil that dynamism and flexibility in your colleagues and teams – it ought to be. More importantly, it’s during change that finance can make its biggest contributions. I worked with a business last year that had run into trouble because contracts had been badly priced. It turned out the sales-driven CEO hadn’t brought their FD into the loop. Needless to say, we could help them with a dynamic finance leader to get the thing back on track.

As these CFOs head to new jobs I’m reminded of advice one FD gave me about moving to a new role: take a blank spreadsheet and build your own top-line management accounts from scratch. To be dynamic, you want to know what your scope for action is, and who you need in your team to execute – not what held back the last team.

Be curious, be sceptical, be rigorous – all the classic FD attributes. But take the initiative too. Dynamism is the key when things change – and even if we can’t predict the shape of 2024 just yet, it’s sure to include a lot of that.

- Ray Nicholls

Things to do...

Now...

Low-risk AI Tech firms are keen to flog AI for ERP and finance. (It’s still vapourware for most of FD stuff.) But try Metaview.ai (which transcribes meetings) and Gong.io, which summarises transcripts (esp. of sales calls) for reports. Low risk, fun, beneficial.

Next...

Refinance Are we still on about this? Yes! Inflation is stubborn in the UK; trade disruption at the start of the year isn’t helping. Timing (and sourcing) of refinancing and debt-raising is still high on the agenda for the year. And spare a thought for commercial real estate refis…

Later...

Quantum compute

Like AI and crypto, it’s been about to be commercial for a decade. But when it does go mainstream, everything changes. I saw the CEO at Universal Quantum, and if he's even partly right, impact on digital security and predictive modelling (FDs on alert!) is staggering.

Lies, damned lies, and...

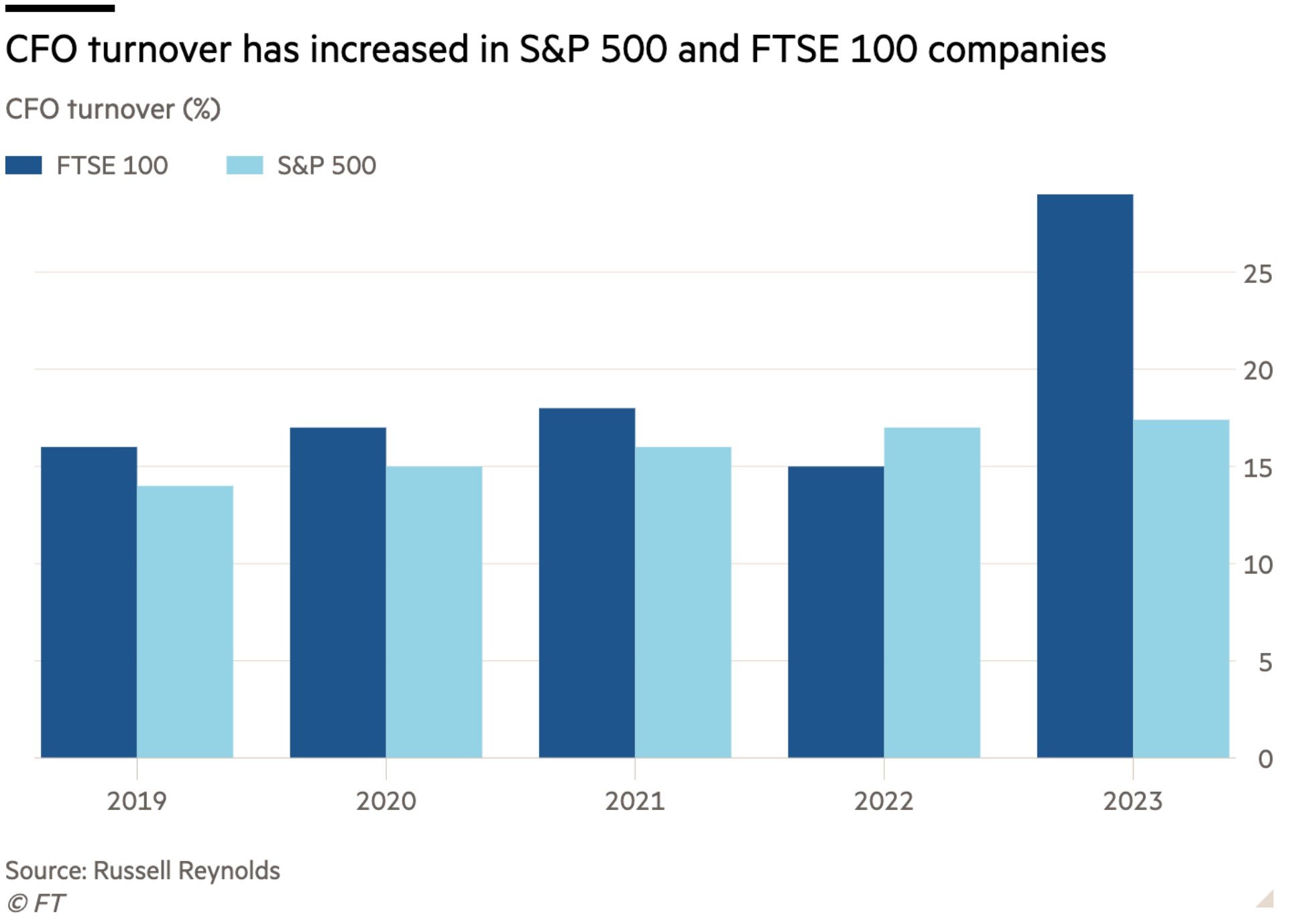

29: a busy transfer window

The CFO-to-CFO story is as old as the hills. But the tally is in for 2023, and the trend hit an all-time high last year. In the FTSE 100, 29 companies changed their CFO in the past 12 months, resulting in the rather exciting (for recruitment consultants, anyway) headline in the FT: “The scramble to find CFOs as departures hit decade high.” (It was a big year for CEO departures, too - 19 of them...)

The top tier corporate posts obviously don’t affect most of us. But it’s not a stretch to imagine that the shuffling of the pack in the rarefied atmosphere of the Blue-Chip world creates openings lower down the hierarchy (not least as many jump ship for dynamic private equity backed businesses requiring chunkier finance teams). Private equity folks are predicting a lot of change as stalled deals get hustled over the finish line this year to churn portfolios.

And the same drivers of movement – boards looking for sharper control as financing remains tight; and seeking more strategic finance folk with a bit of dynamism – might play out in the wider pool of businesses. The CFO-to-CEO move is also a huge reason for CFO vacancies, and boards seek to appoint the exec most exposed to the hard realities of business, and who have experience in IT, legal and even supply chain issues that have risen in importance.

Result? A record number of top-tier CEOs with a CFO role on their CV. That should be encouraging for all of you eying up the top job – and a reassurance that the right finance leadership role, allowing to express that dynamism, is a step in the right direction.

The Bottom Line

Alt-Fi: boom or bust?

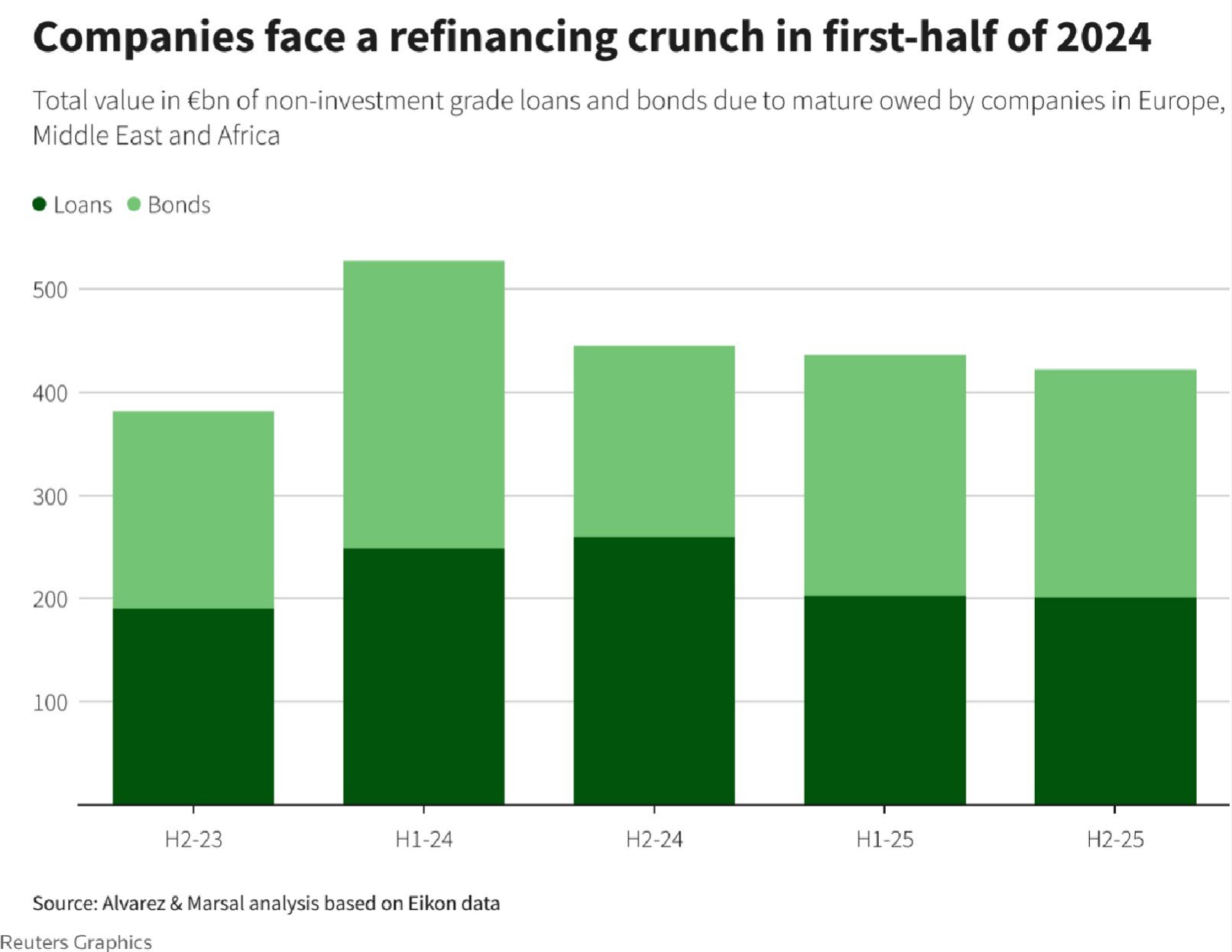

Less than a year ago, bust startup/scale-up lender of choice, Silicon Valley Bank (SVB) was rescued in the UK by HSBC, much to the relief of its 3,000 business customers. But with debt costs creeping up, and lots of private equity money focused on big growth plays, finding sources of alternative funding for smaller and mid-tier firms remains an interesting question for FDs. Bear in mind, there's a lot of debt out there to roll over in the next year or two (see chart, courtesy of Reuters), and that's going to mean looking out for every kind of finance, whether or not your own business has big debt rolling over.

The SVB case shows big banks in the UK are still open to growth company lending (so far). Barclays Eagle Labs, for example, is clearly trying to get clients into different kinds of funding, hoping to get a piece of the action itself. Boutiques are also keen: Rothschild offers “Lombard loans”, where shareholders borrow against their own portfolio of assets. And there’s the usual run of asset-based finance products - the sector supported £314bn of client sales in 2022, up from £276bn in 2021, and 2023 seems to have been buoyant as the price premium was eroded by higher based rates.

So where’s the bust? Well, maturing routes such as crowdfunding and peer-to-peer lending are now coming under regulatory scrutiny. Meanwhile some private equity funds are looking to avoid raising costly new debt from conventional sources are borrowing money based on portfolio valuations. (This includes the “collateralised fund obligation” model at the larger end of the market.) But this kind of activity could be risky for everyone if the model breaks down.

The bottom line? There’s no such things a free lunch. If the board needs fresh funds or a refinance deal, a little extra cost might be worth it if the finance is available more cleanly and from solid providers. We don’t need exposure to the next SVB.

Words from the wise

Don’t write off ESG and DEI

The “anti-woke brigade” found a new hero last month in the shape of hedge fund billionaire Bill Ackman, whose 4000-word tweet (yes, these things are possible under Elon Musk) attacking diversity, equity and inclusion (DEI) policies hit the viral jackpot. Anecdotal evidence suggests some companies are looking again at their DEI programmes, and even on the “classic” ESG (environmental, social and governance) side there are questions: is it worth the effort?

Well, the regulators aren’t letting up – ESG is still a must for larger companies, as it has been for a while. The government is pushing ahead with plans to regulate ESG accreditation agencies, with the FCA this month announced its criteria for sustainability disclosure and investment rules (SDR). That should interest all companies, because while most of the ESG and DEI stuff lands on the largest companies, the real action is around the money.

Many investment funds need ESG status to attract investor cash; that means they need portfolio companies to “do the right thing”. Some US funds might be trending cynical, but in Europe, in particular, funds are still on board. To make your business investable, there's value in ESG.

On DEI, the moral imperative has never gone away. (Less morally: why would you want a team or a company that was biased against people from certain groups?) But our words from the wise are from superstar investor Mark Cuban, quoted in the FT: “When companies do DEI well, you see a well-run, successful company,” Cuban wrote. People trust businesses whose workforces look like them, and when minority employees are comfortable at work they’re more productive. That’s an argument every FD can stand behind.