Sustaining enthusiasm

Do you know anyone saying their business is going great guns right now? If they are (probably on LinkedIn), do you trust them? I’ve been thinking a lot about the value of trust recently, and about two other ‘Ts’ – transparency and truth.

This was all kicked off by reading the new edition of Marcus Sheridan’s book They Ask, You Answer, which says you need to be the most trusted person in your market, willing to say what rivals don’t. It's about flooding customers with frankness and detail before a decision; then offering a menu of services so they can tailor their buy when they’re ready.

That suits my own philosophy. It prompted me to create an online tool to help people decide whether they need CFO in their growing business. Because if you don’t, well, it would be pretty awful for a recruiter to take you on as a client. In the long run, it’s much better to be trusted than to snatch engagements.

So let’s be transparent: assignments have been stop-start at the start of the autumn. I think most of you will recognise that truth, three-quarters of the way through a very uncertain 2025. Decision-makers are nervous. Deal-making is slow; PE exits ditto.

But that’s created time for other things. I’ve been cleaning my contacts database (and having some brilliant conversations as a result of checking in on people I haven't seen for ages); developing an education centre for the web site (to help answer clients questions); and working out what the market’s going to need as we head into 2026.

It’s got me thinking about what the purpose of a recruitment firm is, too. The optimum outcome in this business is people getting the job they want; and clients getting the finance execs they need. Our business drops out of that endgame – but I suspect in many recruitment firms (especially ones with big overheads) those two things are almost by-products of the process, not its objective.

In other words, if my outreach helps people build their career (or optimise their leadership teams) and I’m not directly involved – that’s fine. I trust that in the long run it demonstrates the value Pitch Hill puts on great outcomes for our clients. Meanwhile, spending time with, for example, the folks at the Institute for Turnaround (whose excellent conference I attended last month) gives me a sensitivity to what businesses need – and what finance opportunities are out there for candidates.

Sheridan’s mantra could draw on a much older one, from the movie Field of Dreams: “if you build it, they will come.” There’s a value in trust and transparency – it just takes longer to arrive than a snatched transaction.

- Ray Nicholls

Things to do...

Now...

Budget watch!

Rachel Reeves big day is 26 November. The Budget mood music is ditching manifesto promises on personal taxation, but business taxes face an overhaul - could be a very mixed bag.

Next...

Christmas!

Even with decent sales this year, most retailers need a good Xmas, what with employers NICs and other costs. But in gloom-laden Britain, Xmas parties could be a huge HR boost. Don’t scrimp!

Later...

AI (again).

Can’t escape it... New EU rules on boards’ AI literacy and ‘shadow AI’ on employees devices both demand action. 2026 is the year to get a grip (and find AI’s value in finance, too... if you can).

Lies, damned lies, and...

41% want your head

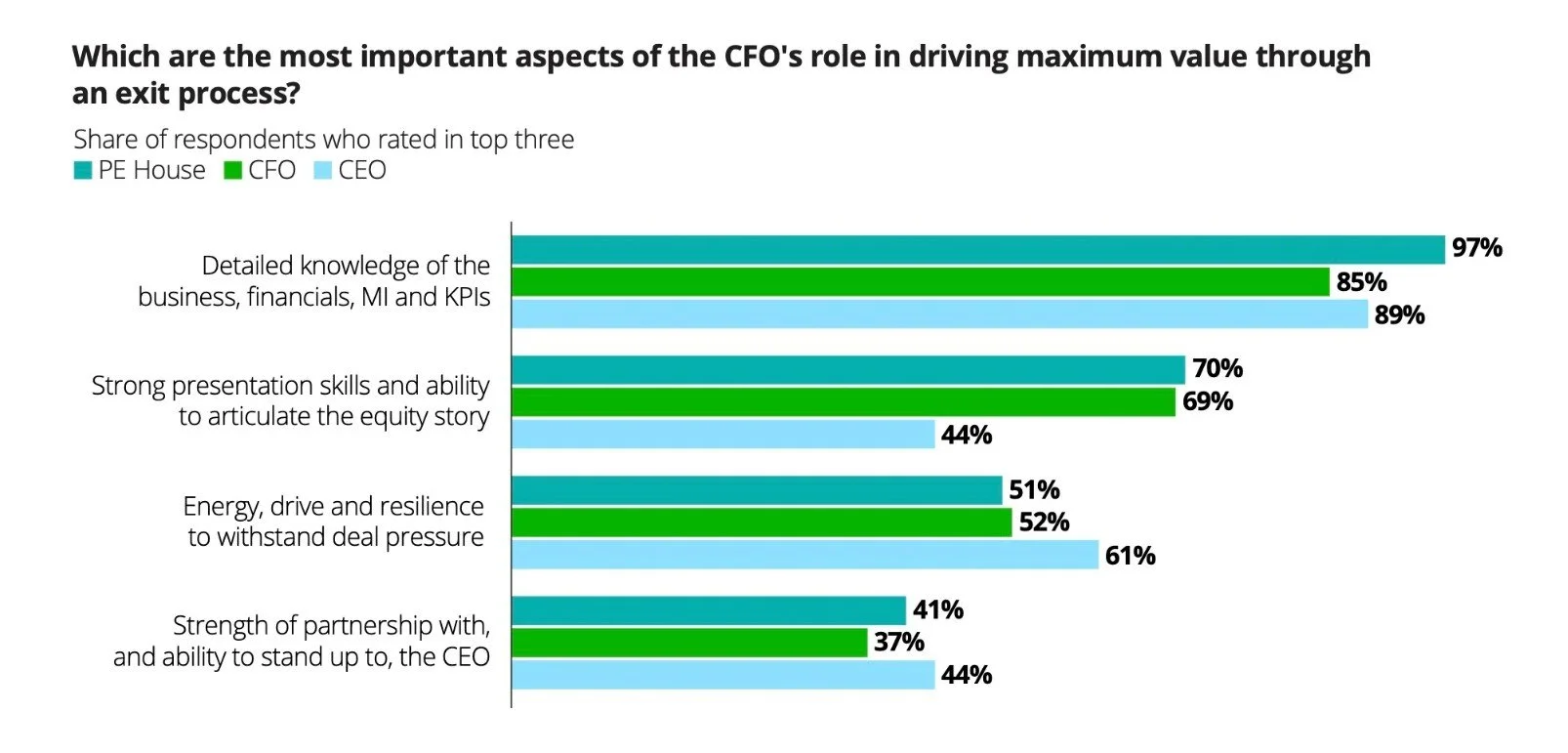

Were they just softening the blow? Deloitte’s new report, Catching the wave: The role of PE portfolio CFOs in maximising value on exit, starts off jolly, emphasising how the finance chief adds hugely to the deal process. The first section is positively effusive: “One third of respondents believe that the positive impact of the CFO could be as high as 20% or more of the value realised on exit. A further half suggest an uplift between 5% and 20%. CEOs tend to take the most bullish view – nearly half believe the uplift could be 20% or more.”

Great quarter, guys! Then the other shoe drops: not only is it still frighteningly common to fire the CFO in PE portfolio companies (see graph below…) with 41% of PE investors reaching for the pearl-handled revolver in a huge 80%-plus of portfolio companies; but with a massive need for exits, any portfolio finance chief without prior exit deal experience is highly likely to cop it.

In other words, you’re absolutely golden but only if you’ve been there before. It gets worse. According to Deloitte: “The lull in deal activity over recent years has contributed to the current cohort of CFOs having less first-hand experience in exits.”

Conclusion? If you’ve been there before you can take your pick of positions. The report’s got some other interesting observations, too – like the fact CEOs are more likely to want CFOs who can “handle deal pressure” – but much less likely to want them to be able to present strategy. Hey, there’s only so much room in the limelight!

On trend

Bubbling Under

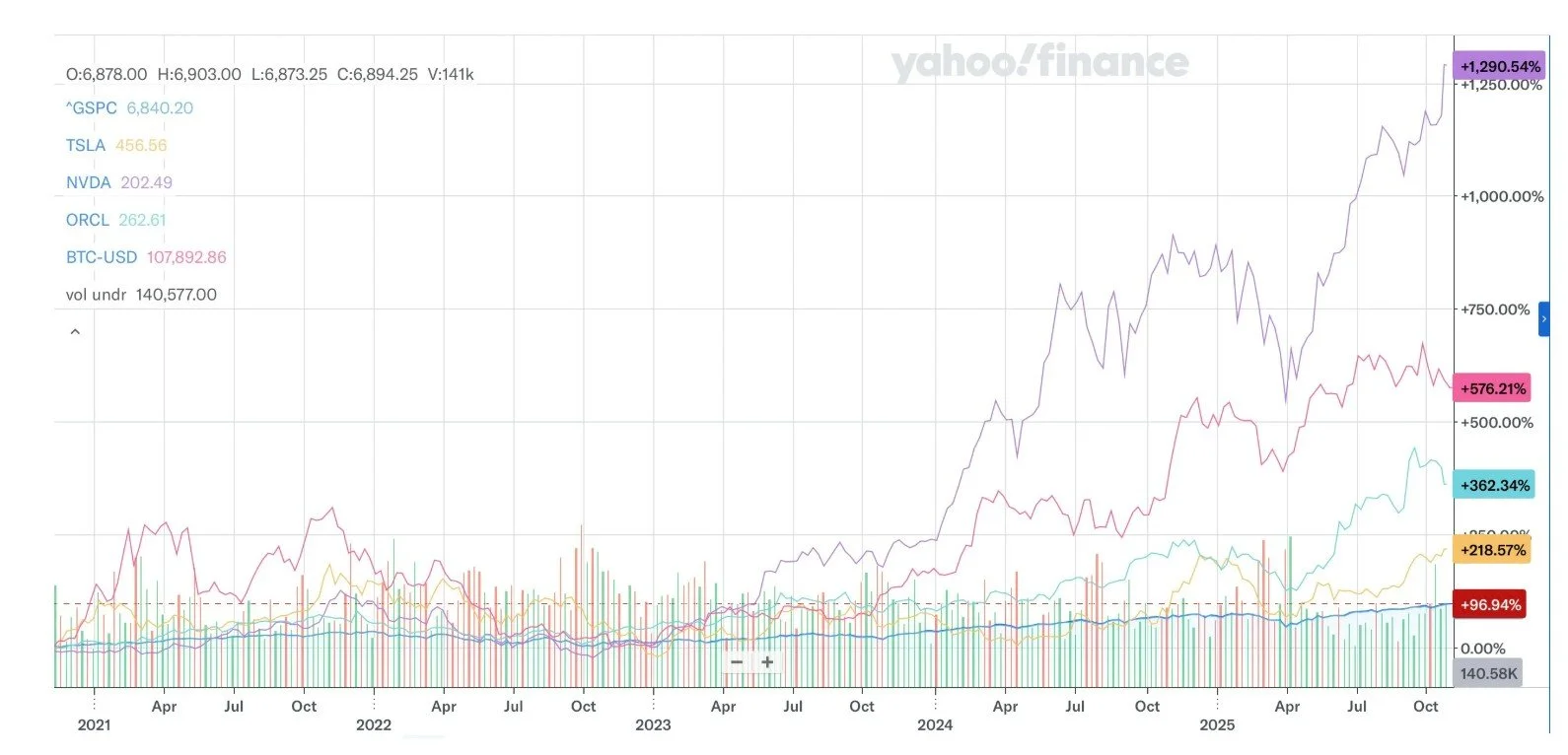

We’re trying so hard to avoid talking too much about AI (at least until there’s something actually worth saying – and, y’know, there are all sorts of interesting things happening…). But the second order effects are more interesting right now. Obsession with the tech is creating what many are calling a great big bubble in equities and a bunch of worrying dependencies in both public and private debt markets, too. (The FT's list of bubble pieces above covers just one fortnight...) For finance execs, that means some interesting capital availability issues – and the worrying prospect of things going pop.

The S&P 500 is up 110% over five years (see below). That’s not normal. Even the FTSE 100 has climbed 75%. But it’s the newbies that have people worried. Tesla’s had a torrid few years, but the stock is back to an all-time high, rising over 200% in five years; Apple up 148%; Microsoft 160% after huge gains in the summer when its OpenAI deals evolved into something like equity; Oracle up 362% “because data”; and AI-friendly chipmaker Nvidia is up 1,520%. That’s more than twice as much as Bitcoin (which, by the way, is due it’s four-yearly correction about now… Don’t say we didn’t warn you.)

But it’s the private markets that have everyone a little spooked. Private equity feels like it’s rushing to correct some long-festering issues, the private debt markets seem like a great way to conceal a lot of systemic risk, and with deals around (privately held) OpenAI routinely running into 12-figure sums… well, it pays to be cautious.

Those of you with long memories can draw on the dot-com crash, and to a lesser extent the global financial crisis and Covid for lessons. But the big one is: when times are tight, seasoned financial managers are always in vogue; when bubbles burst, you need calm heads and a grip on the numbers to see you through.

Words from the wise

There’s still plenty of interesting stuff up at newsletter-cum-blogging-cum-social media site Substack – loads of compelling content written by genuinely smart people. But while it’s probably escaped the Cory Doctorow ‘enshittification’ pathway (we’re good to our users to lock them in; then good to our advertisers to lock them in; then extract every ounce of value for ourselves…), it has become LinkedIn-ified.

That is, it used to be the wonky types writing 6,000-word analyses of the new tariffs on wholewheat, or the psephology of Wiltshire farming constituencies. Now they've have been joined by innumerable motivational business types and advice grifters with lifehacks, wry observations, hyped management fads and such.

So when we went looking there for ‘wise’ folks doing interesting newsletters for finance folks, we stumbled over several posts (see above) about finance execs that varied from the weakly amusing (see below – we do that too!) to the downright stereotypical.

One account we can recommend is Gurwinder Bhogal, whose Prism Substack is generally pretty incisive and thought-provoking (and while he posts reasonably often, the longer reads are infrequent). How can you not love some home-truthing like this: "An easy way to be less miserable is to switch from being anti-things-you-hate to pro-things-you-like."